Last week, the cryptocurrency market as a whole was not over summed up in the words "bittersweet". After the fierce impact of the black swan market on December 13, bitcoin showed its tenacious vitality again. After the price hit the bottom, it began to rebound strongly. Let's see the strong power based on consensus again. Last week, bitcoin's highest price recorded by the whole network was $6900, up nearly 50% from the lowest price of $3700 this year, and the market has recovered to the starting point of the avalanche market. Now it's safe to look back. Bitcoin took the lead in breaking through, up 20% in one day at most to get out of the strong market, and the mainstream currency continued to follow up. The overall market value of the whole cryptocurrency market returned to 170 billion US dollars. To be sure, the current trend of cryptocurrency market is far better than that of mainstream financial market. Cryptocurrency, as a new species, shows strong creativity at this time.

On the one hand, the market trend is getting better, on the other hand, the challenge of mining industry is just beginning. After bitcoin's all network computing power reached a record high of 136.2 eh / s on March 1, in the extreme market on March 11, the computing power once fell back to 97.9 eh / s, a drop of 28%, and then recorded a new low of 88.0 eh / s on March 19, a drop of 35% from the high on March 1, which is also the lowest point of bitcoin's all network computing power in the last half year.

The industry is picking up, and many miners are falling forever.

1、 There is a partial vacuum in the calculation force of the whole network. Where is the calculation force gone?

According to the industry data inventory of the past week by rhy mining weekly:

Last week, the bitcoin network average computing power was 96eh, which was lower than 100eh for five consecutive days. It can be sure that bitcoin network computing power is quietly losing. 40 eh less than the peak of the whole network computing power this year, and a quarter of the whole network computing power has been lost. The reduced computing power is equivalent to the scale of 2.5 million ant S9 mining machines lost in the past week.

In addition to bitcoin, litecoin and Ethereum, both of which are POW consensus mechanisms, are suffering from the decline of computing power in the whole network. At present, mining industry based on POW consensus has shown a state of partial vacuum of computing power, which is the inevitable result of mining adjustment lagging behind the market trend, and also the dynamic process of miners constantly playing games to find a new mining balance point.

According to the actual situation, it is speculated that the following key factors are responsible for the general breakout of the mainstream network computing power:

1) : all the mining machines with an energy efficiency ratio of more than 75j / t touch the profit and loss line when the mainstream mine uses electricity. Taking ant S9 mining machine, the largest one in the market, as an example, the current profit ratio of mining is - 21%. The cost of money obtained by mining is higher than the price of the secondary market, which causes the phenomenon of hanging upside down, and the mining machine is forced to shut down, which is only the main reason.

2) : some miners with levers may have a situation of warehouse bursting. The miner is in the stage of being frozen and to be liquidated, and it is temporarily unable to operate.

3) Some news shows that some large mines have begun to make room for new machines to move domestic unprofitable machines to overseas areas with lower power costs. Before the delivery of new machines, there are no machines to run in these mines.

4) Because of the lack of data storage capacity and other reasons, the ant E3 miner that specially digs the Ethereum network will quit the excavation of the Ethereum network in the near future, and the computing power of the Ethereum network will decline.

5) Because of the algorithm compatibility, in the case of the failure of the mainstream bitcoin mining machine in the whole line, some bitcoin network mining machines switch to the bitcoin network for mining, which diverts the whole network computing power of bitcoin.

Mining is not an independent activity between miners in different main nets. In fact, the calculation force is fluid, and usually overflows from the place where the calculation force is too high to the depression. Especially in the current situation of the machine gun pool (a behavior of flexibly switching mining targets between the main networks compatible with the algorithm to maximize mining revenue), the liquidity of computing power is more flexible and free. Where mining is more profitable, computing power flows. The network with greater consensus has become a disadvantage because of the excessive competition, which is prone to the outflow of computing power. This has exacerbated the vacuum effect of the whole network computing power. It is expected that the vacuum state of the whole network computing power of bitcoin will not be filled in a short period of time.

2、 As computing power is reduced, the adjustment mechanism of bitcoin survival is effective

As a result, the intensity of mining competition among miners decreases sharply, and the monetary standard income of mining per unit of computing power increases significantly. Bitcoin's mining difficulty adjustment mechanism is to reset the block difficulty in each mining cycle (usually 14 days) according to the actual situation of the total computing power of the whole network. In the past mining cycle, if the average computing power of the whole network is increased, the mining difficulty will be increased automatically; otherwise, the mining difficulty will be reduced, so as to ensure that the speed of bitcoin main network block output is basically stable at the rhythm of 10 minutes / block.

As the calculation force declines in a short time, and the current mining difficulty of 16.55t is adapted to the calculation force of the whole network in the previous period, the actual block out speed of the whole network will be slightly lower than the theoretical value. It is estimated that the next mining difficulty update will be reduced to 14.59t by more than 11%, which may be the biggest reduction in bitcoin mining difficulty in the past year. After a new round of mining difficulty adjustment, the average mining income of the miners in bitcoin field will be more than 10% higher than the current one. The competition of the relative advantage between the miners has become a situation in which the winner takes all In such a competitive relationship, there are three types of miners who have become beneficiaries after the market crash.

1): Miners with large computing power: Miners with energy efficiency ratios of 50J / T and below occupy a favorable position in the current relative competition, and they are also the main miners remaining in the field.

2): Cloud computing miners: Cloud computing miners and cloud computing platforms are interdependent. When the market price drops sharply, in order to maintain the mining profits of miners, the cloud computing platform with mature risk control system will actively subsidize the cloud. The power cost of hash power miners, and try their best to reduce various processing expenses by optimizing operations, and maintain the stability of the cloud computing platform ecosystem. Therefore, the cloud computing miners who chose the right platform for this part have caught up with this wave of computing power vacuum. Mining bonus period. As the so-called leaning against the big tree really enjoys the cool.

3): Miners with special advantages: According to the statistics of theoretical data, the 14nm miners that account for half of the computing power of the entire network should be eliminated, but at present, only a quarter of the computing power of the entire network is eliminated. A quarter of the high-power mining machines survived stubbornly with their unique power and energy advantages. These mining machines will earn higher mining coin revenue than they did before.

After ten years of development, the inherent logic of mining is no longer a competition between pure machine performance. Relying on a stronger system, enjoying the intensive advantages brought by large-scale operations, looking for more advantageous energy sources, etc. are enough to form differentiated competition among miners. This differentiated competition is the foundation for miners to replace the endless arms race. Way out.

3. Cloud computing miners outperform traditional miners, which is a reality that must be faced

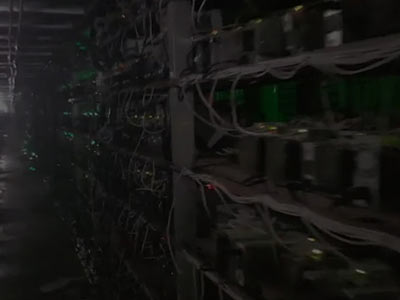

For a long time, cloud computing mining has been an area marginalized by the mining industry. The industry presence of cloud computing miners has also not been strong, and traditional miners have been regarded as "friends" of the mining industry. Traditional hard-core miners need to be independently responsible for all mining links, such as purchasing machines, assembling and commissioning machines, and selecting suitable mines. Both capital investment and time and energy are far higher than cloud computing miners. According to the relationship between input and output, traditional miners who master the means of production (mining machine) and production technology (mining expertise) should get higher mining returns to be reasonable. However, under extreme conditions, the vulnerability of traditional miners is surprising. At least most cloud computing miners currently outperform traditional miners.

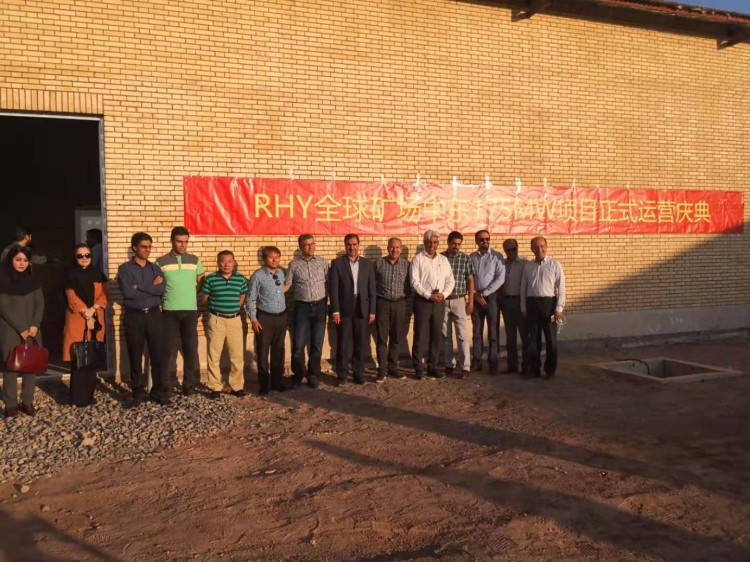

This kind of industry upside-down phenomenon makes many traditional miners uncomfortable and confused, and they have a day when they can't do cloud computing. Let's not compare the ant S9 that is outdated, just take the most mainstream high-power mining machine Shenma M20S (68T) as an example. The average price of a single unit of the Shenma M20S is 12,000 yuan per unit. In the current market, the daily net income is only about 15 yuan. The entire return period of the Shenma M20S requires at least 800 days, which is more than two years. On the RHY platform, the one-year product of cloud computing power is 209 / T (including the annual electricity bill). According to the current market, the annualized return rate of cloud computing power is 112%, and the advantages and disadvantages are clear at a glance.

This gap lies in the ability to withstand risks. Under the extreme market conditions, the advantages of cloud computing power are amplified, while the vulnerability of traditional miners is just over the threshold. Cloud computing mining mode is more resilient than traditional miners.

1): The one-time investment of traditional miners is too large, and it bears too much pressure on fixed costs, and it is easy to be stuck in the market. The cloud computing power miners are much more flexible in investment, and can be gradually purchased in batches, which comprehensively reduces the cost of computing power.

2): Compared with cloud computing platforms, miners lack the ability to negotiate prices in the market. Most miners have less than 500 mining machines. Even with a larger volume of miners, they still cannot show the cost advantage in front of the cloud computing power platform built by their own mines and power plants, facing extreme market conditions. Lack of room for return.

3): Traditional miners have no reliable objects, and the cloud computing power platform and cloud computing power miners are both advancing in the face of profits and risks. When the market goes down, the RHY mine can give platform miners electricity fees and Reduction and exemption measures on fees, and the market will not give any miners any profit.

Of course, you may say that cloud computing mining is better than mining with your own mining machine. This is only a small probability event in the face of extreme market conditions. Most of the time, traditional miners' profits are still hitting cloud computing miners. This view is correct in itself, but what we are not sure is: how long will this market last? How often do we encounter extreme quotes every interval? Can the profits of insisting on independent mining in the middle hedge the risk of this extreme market?

Logically: If there is a probability that something will happen, then it will happen 100%. If mining is considered as an investment, the priority of stability in the face of risk is definitely higher than the rate of return on revenue. Mining has bid farewell to the rough and refined era, and cloud computing power is an asset allocation for miners. This method will be re-examined under this extreme market. You may not accept it, but please be sober-faced with reality.