Bittland once again seeks to go public, can the water of the capital save the blast of the mine?

Hot market, anxious people, facing the secondary market that has been launched since April this year, the most regrettable thing in the circle is to step into the air. The market is like a fire, and when the market goes to the sea, no one can predict how long this wave of market will continue to rise. However, the miners who are rushing through the market because they can't buy a mining machine are undoubtedly anxious every day. As the most upstream mines, the pressure they have to bear is even greater. The sum of the urges and complaints of the miners is the pressure limit that the mines have to bear.

Recently, there is a definite news that the mining machine manufacturer Jia Nan Gengzhi and Bitland have submitted their listing applications to the SEC (US Securities and Exchange Commission). The specific listing plan of Jianan Zhizhi has not yet been announced, and the proposed amount of funds raised by Bitian is 3-5 billion US dollars, which is planned to be listed on the NASDAQ stock exchange.

In the face of the backlog of mining machine orders, these big manufacturers in Bitland chose to ask for help from the capital. This listing application is more urgent than the number of listing attempts. From the determination of Bitcoin to be willing to value the market, the success of this round of listing is related to the survival of miners.

One: the major gas injury, the mine to the capital market to save money

The minds of miners seeking to go public are not a day or two. Taking Jia Nan Zhi Zhi as an example, since 2016, he intends to use the shell Lu Yitong to be listed on the Shenzhen Stock Exchange's entrepreneurial version and was denied by the regulatory authorities. After that, he tried to log in to the New Third Board and Hong Kong stocks and lost.

Bittland also tried to log in to Hong Kong stocks in the middle of last year and announced plans to run aground in March this year.

Failed to finance the winter before the deterioration of the secondary market, so that the miners were almost frozen in the winter of the bear market in 2018. At the beginning of 2019, Bittland handled the stock of the ant S9 series of mining machines and several mines under the name. The ant s15 series mining machine of the 7nm process chip just released at the end of last year is also suffering from the sadness of the price in the bear market.

As for Jianan Zhizhi, it has continued to slump since the release of the industry's first 7nm process chip last year. At present, the main products of its mining brand Avalon, Avalon 1066, 1047 and other miners are still using the 12nm process. A generation of chips, the giants in the industry in the past two have been significantly behind the market after a cold winter.

The sudden recovery of the market caused the mines to recover a little bit of vitality, but the lack of market estimates made them not stabilize the dividend of the market.

The lack of capacity in the market is currently the most difficult problem. Even if this year's futures have been pre-sold, but the stock of special chips limited to components, especially the production of mining machines, is seriously insufficient, and the return of blood that the mines can obtain from the market is very limited.

According to relevant reports, it is estimated that Bitumin's current supply of 7nm process miners is only about 40,000 units per month.

In order to raise more funds, Bitian does not hesitate to over-sell the mining machine to get the payment in advance from the large-scale cooperation partners. At present, even futures cannot be supplied in sufficient quantities, and many partners are calling for pits.

Lack of money, become a life and death bureau before the mine scene. For the time being, the hope has been clearly seen, that is, I don’t know who will fall before dawn.

Listing financing has become a good medicine for miners to save lives. As long as they have the money to continue to replenish their production capacity, they will be able to stand on the peak.

Second: expedited, increased production market feedback in general, the problem has not been resolved

Well-known bloggers "Digital Chips" broke out in mid-July. Bitcoin has submitted wafer orders for TSMC in March and April this year. The total number is 30,000 7-nm wafers with 12-inch wafers. 2 billion yuan (288225969.1598 US dollars), the transmission of the mainland has been fully prepaid, the condition is expedited production.

TSMC also sent a positive signal, and has sent a team to Japan to urgently purchase production equipment and increase the production capacity of 7nm process chips.

However, the fact that can't be changed is that TSMC is making every effort to produce chips for Apple phones listed in September. On the customer priority list, Qualcomm, Huawei, Xiaomi, Meizu and other mobile phone hardware manufacturers have higher priority than Bitcoin. A group of mining machine manufacturers.

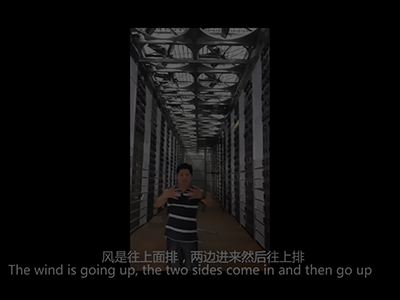

Although the market has been able to feel the efforts of the mines, the shortage of mining machines continues. According to the report of deepflow, it is customary for the delivery of this batch of wafers to be three months of filming, and then the packaging, testing, assembly, finished product performance testing, etc. need a short time.

It is expected that the time of delivery of large-scale mining machines by various miners will be in the second quarter of next year. And in the middle of the half-year period, the market trend will change in the end. No one can guarantee that the miners who have paid the full deposit in advance will be somewhat dilemma.

Even if there is sufficient capital to enter immediately, it is difficult to save the near fire. After all, the mines should be tied to the fire and grilled, and the fuel for ignition may be the miners themselves.

Three: The mines are short of money but they are not lacking money.

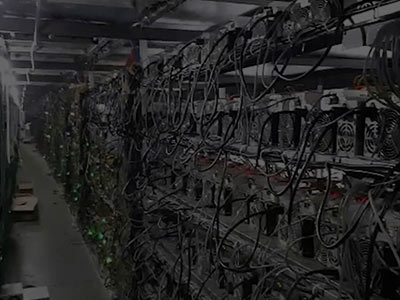

Bitland has sealed the king mine with an ant mine machine. The most classic ant s9 series shipped millions of units, accounting for half of the industry's mining machinery holdings, and in 1998, it has generated billions of dollars in sales for Bitland.

It is also the success of the ant mining machine s9 that Bitumin's prospectus submitted in 2018 has a revenue increase of several hundred percent and a net profit of one billion dollars.

On the surface, miners are short of money to increase production capacity, but we still believe that it is not just money that plagues the former industry overlord.

I don't know when it started, and even the industry leader such as Bitcoin slipped out of the list of chip suppliers' first priority. The experience of other manufacturers in the industry can be imagined.

The bull market will come sooner or later, and the bear market has its inevitable rules. It is the crux of a physical hardware manufacturer that mining machine manufacturers can smooth out the fluctuations in sales during the market conversion and maintain the ability to continuously produce and sell mining machines.

The choice of listing can only increase the mine's own cash flow preparation and anti-risk ability, but as the upgrade cost of the mining machine is also rising exponentially.

The unit price of the ant mining machine s9 is 2000 + RMB (288.226 US dollars) and the unit price of the s17PRO mining machine has soared to more than 30,000 RMB (4323.3895 US dollars). Once again in the next round of market, once again caught in the situation of mining machine sales, bit mainland and many mining machine manufacturers to survive the cold winter is almost impossible.

The risk of market volatility is rapidly increasing in mining machine manufacturers, and choosing to use capital to resist the risk does not seem to be a reality. Today, capital can benefit from the bull market, and he will also suffer from the bear market.

Finding a more reasonable market mechanism to hedge against volatility is the fundamental way out. Regarding the strategy of how mines can effectively counter market volatility, we see this conclusion from the weekly report of the RHY mine:

1): The mine has become able to predict market volatility and prepare capacity in advance. This kind of advance must be based on the quarter, otherwise it has no practical significance. Obviously this is impossible.

2): Find the buffer mechanism in the market, such as realizing the stock in the self-operated mine, or sharing the profit and the insurance with the retail investors in the mode of calculating the lease and mining machine. Take the RHY mine itself as an example. Regardless of whether Xiongniu City's power lease has its return-based profit model, the difference is only the level of return. Even the demand for mining machines in the winter of last year has not stopped.

Bitcoin has also been laid out in this respect. The online deer is based on the consideration of realizing heavy assets, but the volume is still small.

3): Adopting the traditional distribution and agency model, the layer of laminated goods shares the inventory pressure. This practice may not be highly acceptable in the mining area, because the layered fare increase is finally passed on to the miners' heads to increase the cost of mining.

In summary, the listing of miners can solve the problem of severe asymmetry in market supply and demand in the short to medium term, but it has no obvious effect on the long-term fluctuation characteristics of the industry. Instead, it may lead to increased competition due to capital adequacy. Weaken and brew a bigger disaster.